Israel has officially introduced changes to its CTC (Continuous Transaction Controls) system, accelerating the implementation timeline for the invoice allocation number request obligation. This obligation requires taxpayers to obtain a unique allocation number from the tax authority for invoices above certain thresholds, ensuring real-time verification of transactions.

The changes to the implementation timeline were enacted through the Law for Achieving Budgetary Goals and Implementing Economic Policy for the 2025 Fiscal Year, as part of the country’s efforts to combat fraudulent invoices through technological means.

Accelerated Timeline for Invoice Allocation Numbers

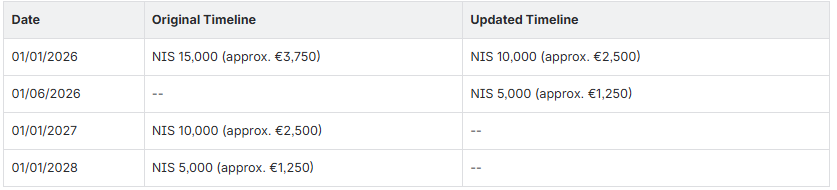

Under the original implementation schedule, businesses were subject to a gradually decreasing threshold that would have reached NIS 5,000 only by 1 January 2028. However, the new legislation significantly accelerates this timeline:

This means that the NIS 15,000 threshold will be skipped, and:

-

From 1 January 2026: businesses will need to obtain allocation numbers for invoices of NIS 10,000 (approx. €2,500) or mode (VAT excluded)

-

From 1 June 2026: businesses will need to obtain allocation numbers for invoices of NIS 5,000 (approx. €1,250) or more (VAT excluded)

Additionally, amendments to the country’s Income Tax Ordinance have been made, creating a link between VAT compliance and income tax deductibility. Effective 1 August 2025, if an allocation number is required for deducting input VAT and such number was not duly allocated, the related expense will not be deductible for income tax purposes. This represents a substantial enforcement mechanism, as non-compliance with the CTC allocation number obligation now affects both VAT and income tax deductions.

To learn more about the Israeli CTC obligation and e-invoicing requirements, access our Sovos dedicated webpage.