Customer Onboarding: From First Contact to Loyalty

Optimize, protect, and elevate your onboarding with Sovos. In an increasingly digital world, an efficient onboarding process is key to converting customers, reducing fraud, and

Optimize, protect, and elevate your onboarding with Sovos. In an increasingly digital world, an efficient onboarding process is key to converting customers, reducing fraud, and

Technology at the center of the Tax Reform. Check out more about it and stay up to date with updates. | Read more here

Discover how digital trust is built within Latin America’s financial ecosystem through real-world cases. Explore the current landscape of fraud in the region, emerging risks,

The DGII informed taxpayers identified as large local and medium-sized Taxpayers whose deadline for the implementation of the Electronic Invoice was May fifteen (15), 2025,

The authority issued exempt resolution No. 53 through which it establishes the obligation to deliver the printed or virtual representation of the e-ticket and/or the

The tax authority established that as of September 1st, 2025, sales made to end consumers for amounts greater than CLP$5,186,253.15 must be identified in the

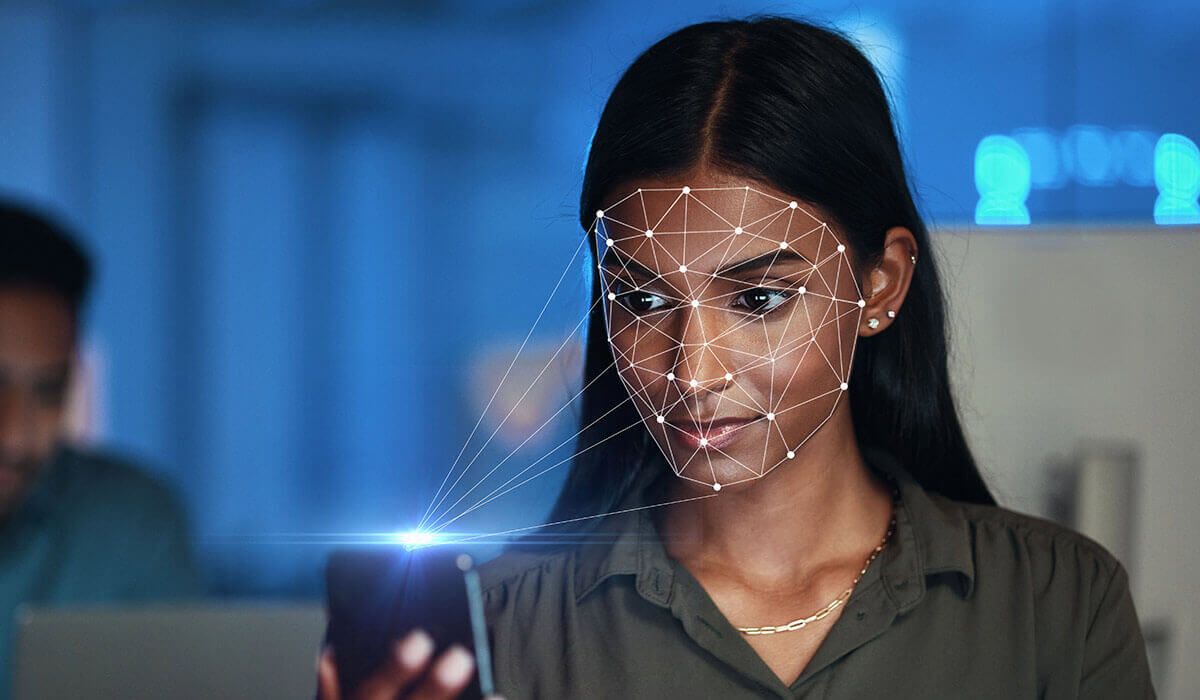

Customer Story Large Latin American Bank Undergoes Digital Transformation, Reducing Fraud Rate by 70% Products ID Verification e-Signature Document Management Company Information $13.6B Revenue 200K+

Telecommunications Company in Latin America Undergoes Digitial Transformation, Reducing Fraud by 70% and Manual Operations by 60%

In this webinar, you’ll learn about the strategic role of this key ally in optimizing processes, aligning teams, and boosting productivity with a focus on

Digital transformation has become an obligation and a strategic decision for all organizations seeking to protect their data and ensure the identity of their users.

Several changes are expected in Brazil in the long term as a result of the tax reform. This represents a transformation.

Electronic invoicing in Ecuador Electronic invoicing in Ecuador, also known as Facturación electrónica, is mandated for established taxpayers. Like many Latin American countries, Ecuador was

Important changes in Costa Rica’s electronic receipt regulations have been introduced by the tax authority through the new mandate 44739-H. This new regulation, published on

As of July 1, 2025, taxpayers registered with the activity 41000 (Construction of architectural works), even if it is not the main one; they must

The SII issued Circular No. 19 to provide more details on changes introduced by Law No. 21,713 to the Tax Code. One key change is

In late 2024, the Philippine government enacted the CREATE MORE Act, introducing several amendments to the Tax Code, including changes to e-invoicing and to the

On January 31, resolution No. 000003-2025-SUNAT/700000 was published. With this resolution, the application of the discretionary power regulated in the Resolution of the Deputy National Superintendence of

On January 31, resolution No. 000003-2025-SUNAT/700000 was published. With this resolution, the application of the discretionary power regulated in the Resolution of the Deputy National Superintendence of