This blog was last updated on March 11, 2019

The UK is likely to be one of only a handful of countries in the world that regularly publishes a report that looks at its tax gap in detail, and last month HMRC (the tax authority in the UK) published its annual report for 2016-17.

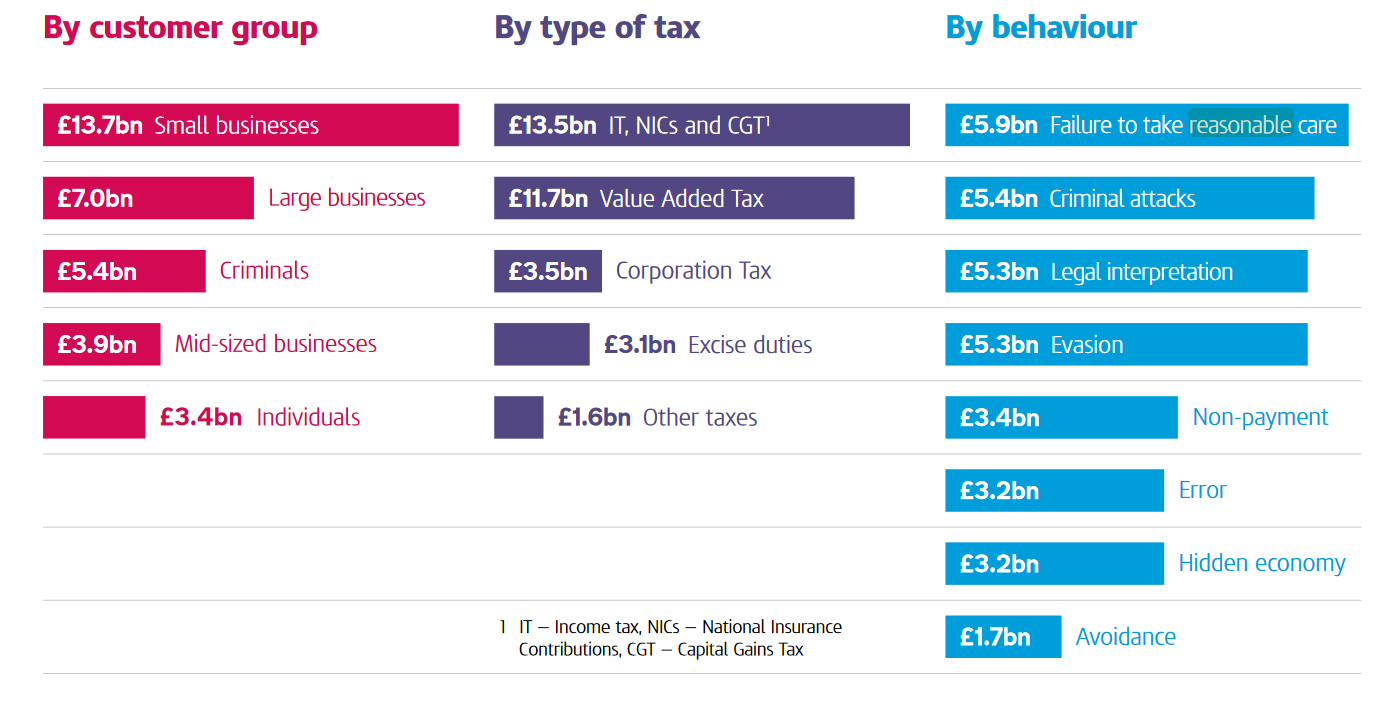

According to the Measuring Tax Gaps report, the overall tax gap (direct and indirect taxes) in the UK for 2016-17 was £33 billion, which represents 5.7% of tax liability calculated. The total VAT gap was estimated to be £11.7 billion, which is just over one-third of the overall UK tax gap.

|

Mind the tax gap: the tax gap is the difference between the expected tax revenue and the amount collected by the Tax Authorities. Tax gaps can arise due to many reasons, such as tax avoidance, tax evasion, tax fraud, criminal attacks and legal optimisation schemes, but can also be caused by the simple act of failing to take reasonable care. |

The below table highlights the key findings of the report broken down by customer group, tax type and behaviour:

Source: HMRC Measuring Tax Gaps 2018 Edition

Source: HMRC Measuring Tax Gaps 2018 Edition

While tax experts may be quick to dismiss the findings of the report, highlighting that it underestimates the size of Britain’s tax avoidance problem, the report and HMRC’s methodology in compiling it does show that the UK is following the trend toward a long-term reduction in its overall tax gap (which stood at 6.6% in 2013-14). But while a reduction of the gap can only be a good thing for the UK, it’s the chasm of change that lies ahead, for the UK and its government that is where the HMRC should have its eyes firmly fixed:

Brexit

The Brexit withdrawal arrangements were formalised in March 2018, when it was announced the UK would be leaving the European Union on 29 March 2019. Since then the UK and EU have been locked in a deadlock over the issue of the Northern Ireland border and what form their future relationship around trade might take.

With just months left until the crucial October deadline of agreeing the outline of what the future relationship of the UK and EU will be, the possibility of a no-deal is edging ever closer. If no deal is agreed upon ahead of the March 2019 deadline the commercial operations between the UK and EU Member States will no longer be considered intracommunity transactions, but instead be subjected to the World Trade Organisation rules for cross-border duties and procedures.

A no-deal situation will mean that the UK will not be able to continue operating under the Single Market rules that harmonise VAT and excise duties. This will bring major changes to supply chain flows, as well as an increase in cost for inbound and outbound trade to the UK.

That is why it is vital that the UK and the EU agree what their Brexit relationship will be. Having a plan in place will reduce the immediate impact caused by the UK abruptly exiting the EU as Theresa May, the British Prime Minister, has negotiated an ‘implementation period’ with the EU that would allow the UK to transition from its full EU membership to its post-Brexit relationship. During this transitionary period the UK would continue to follow EU rules for indirect taxes meaning it would be subject to:

- The current customs procedures for the movement of goods between the UK and EU will be maintained;

- The harmonised VAT regime and excise duty applicable to the UK will be maintained;

- The existing rules to transactions commencing on 31 December 2020 ending on or after 1 January 2021 will be applicable, with VAT obligations being extended in respect of these transactions to five years after – 31 December 2025.

Preparing for a no-deal

Once the UK leaves the EU, it becomes a ‘third country’ for VAT trading purposes. And if the UK does leave the EU with no deal and no transitionary period, businesses established in the UK will not be part of the EU VAT-free trading area and will have to pay custom duties related to transactions with the EU. Even though the approximate 20% VAT burden can be reclaimed afterwards, businesses will need to prepare for a hit to their cashflow and adjust to the new commercial terms.

By leaving the VAT regime the UK would have more autonomy to set its VAT policy in terms of rates and what it is levied on. And this could lead to greater VAT divergence between the UK and the EU as the two regimes may drift apart.

Making Tax Digital

HMRC’s “Making Tax Digital” project is scheduled to come into force in April 2019, just after the UK formally leaves the EU. The project is an ambitious plan to turn the UK into one of the most advanced tax administrations in the world in terms of digital controls.

Under the proposal, all VAT registered businesses with taxable turnover above the threshold of £85,000 will maintain digital records for VAT, including VAT returns which will be submitted online from April 2019. To comply with the requirements, businesses need compatible software that meets the specification requirements to handle the VAT return files, demonstrate a clear electronic audit trail and connect to the HMRC systems through an Application Programming Interface (API).

This means that UK businesses will need to adapt to two new realities at the same time: first of all, deal permitting, whatever the post-Brexit scenario will be and, secondly, the switch to a digitised tax system which has limited exposure amongst UK businesses.

Even though the intention to modernise the UK tax system is meritorious, the implementation schedule may not be the best placed, coming into force in the planned transitional period when the UK leaves the EU and companies are rushing to adapt to the new system. Despite that, the initiative of the UK in making the tax system digital is in line with substantial investments all the European Member States are making with the implementation of sophisticated schemes to close – or at least reduce substantially – the VAT gap by implementing real-time tax assessment. In this regard Italy is leading the way but, other countries with large VAT gaps, such as Portugal, Greece, Spain, and Hungary, have also manifested the willingness to implement clearance-like invoicing systems. With the implementation of Making Tax Digital, the UK is taking a step forward, but, in our view, is unlikely to implement a real-time tax clearance platform in the foreseeable future.

Take Action

Discover more on tax in the UK and Sovos TrustWeaver.