This blog was last updated on May 6, 2021

Although insurance companies do their best to settle their tax liabilities in the most compliant manner, historical liabilities may still occur. Here is an overview of the different types of historical declarations with some insurance premium tax (IPT) examples.

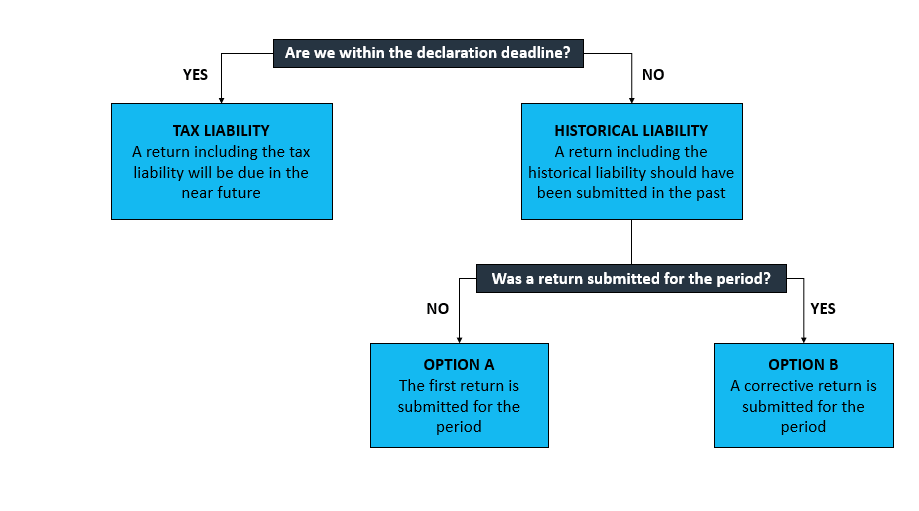

When a tax liability becomes a historical liability

Let’s start with a simple chart:

Are we within the declaration deadline?

Firstly, investigate whether the liability discovered (e.g. during an internal audit) was due to be declared or not.

For example, in Italy there is an annual return obligation. If a liability has been missed in December 2020 for the January 2020 calculation, the annual return for 2020 will include the correct amount of the liabilities for that period and be submitted on time.

Everything appears fine but don’t forget about payments. Although in this Italian example the declaration hasn’t been missed, the payment deadline was. Consider the settlement deadline when making the additional payment and penalties and interest must be paid accordingly.

On the other hand, let’s look at another case: the biannual ASF surcharge in Portugal. If in June we have mistakenly not calculated ASF for a policy line in January there won’t be any penalties or returns to correct as ASF is declared and paid only on a biannual basis, for this particular case, in July.

Was a return submitted for the period?

The next question is whether a return has been submitted for the period when the historical liability was due.

In the case of ‘Option A’ (the first return is submitted for the period) where no returns were submitted for the period it’s clear that the historical return should include the total liabilities for that period, as nothing has been submitted at all.

Option B is when the insurer submits a corrective return for the period. However in the case that the insurance company already submitted the return, then it’s important to question the corrective return. Should it include all liabilities for the period, i.e. adding the originally declared liabilities to those newly discovered.

The bad news is that unfortunately the answer depends on the territory. This rule varies by country and tax by tax. Even in the IPT world there is no common approach. Be aware of the country specific requirements.

For example, in Hungary the total liabilities for the period should be included in the monthly IPT return. There is an additional sheet in the return which provides details to the tax office about the originally declared IPT amount and the total liability for the period. This enables the software to calculate the additional liabilities to be settled.

In the case of the German IPT and the FBT return although the total liabilities are included in the corrective return, no reference is made to what has already been settled. This means the payable amount and the declared amount will be different.

In both examples a box must be ticked as part of the submission. This notifies the tax office that the return is a corrective return. If the box isn’t ticked the tax office will require the return to be corrected and resubmitted.

Other examples include Denmark and Cyprus, where only the additional liabilities need to be declared without any reference to the originally declared return or whether a return has been submitted for the period or not.

Penalty and interest payments

Next, ask whether or not to pay penalties alongside the submission of the historical returns. The answer yet again depends on the country.

For instance, the Hungarian IPT return requires calculating and including the amount of the so called ‘self-revision fee’ into the return when submitting a return to correct a previously submitted return.

While in Germany, the tax office levies the penalties following the submission of the corrective return. These penalties are calculated when the corrective return includes additional liabilities for that period.

What about cases when historical liabilities are refunds?

We previously discussed negatives so to avoid repeating ourselves we will only mention that some territories allow negative returns whilst others don’t. Those not allowing negative returns require either a special form or an explanatory letter alongside the supporting documentation to reclaim overpaid IPT. In Italy’s case there is rigorous treatment of the negative policy lines.

In summary, before settling historical liabilities consider these questions. Act only when the answers and all relevant information is available. Here at Sovos our experts are happy to help and share their knowledge and expertise. We will ensure you remain compliant even in the case of historical liabilities.

Take Action

Download Trends: Insurance Premium Tax to read more about tax compliance and the insurance landscape and follow us on LinkedIn and Twitter