This blog was last updated on February 8, 2024

At the Nationwide Tax Forums in Chicago last week, the IRS communicated details about the first wave of backup withholding penalty notices that payers should expect to receive in September and October. These new penalty notices are related to the enforcement campaign that kicked off from the IRS Cincinnati office in July.

Background – Backup Withholding

The IRS first announced the intent to launch an enforcement campaign aimed at backup withholding compliance in late March at the American Payroll Association’s Capital Summit in Washington D.C. IRS Director of Examination Operations & Specialty Tax Dan Lauer, described the ongoing issues the IRS has with payer compliance to Tax Notes.

“There’s so many compliance challenges,” Lauer told the publication. “Withholding is such an important part of tax administration. If people don’t withhold and then they report, then we have to spend collection resources a lot of [the] time, [set up] payment installment agreements, and other things in the collection arena. So it’s a little bit of a short-term loss for a long-term gain.”

In late April, other IRS leaders attended a banking and insurance industry conference and provided more clarity around the emphasis of the enforcement campaign.

Following are the key enforcement points that were discussed at both events:

- Forms 1099 filed with backup withholding amounts reported in Box 4 but no corresponding Form 945 filed with IRS,

- Form 945 filed with IRS but no corresponding 1099s filed with withholding amounts in Box 4,

- Forms 1099 filed with missing TINs and no backup withholding amounts in Box 4,

- Form 1096 transmittal filed with withholding amounts but no corresponding Forms 1099 or 945 withholding amounts or returns filed.

Updates from the IRS Nationwide Tax Forum

In Chicago last week, Lauer conducted a presentation related to backup withholding and employment tax implications. To emphasize the importance of this topic, he began by citing statistics from the Office of Management and Budget that forecast that by 2020, more than 75 percent of US tax revenue will come from withholding at the source. While backup withholding is only one form of source withholding taxes, it is generally triggered when a reportable payment is made and the payer failed to collect valid taxpayer information from the payee.

Failure to report valid taxpayer identification information (TIN) on Forms 1099 and/or W-2s, makes it virtually impossible for the IRS to match off the income reported on those forms to a taxpayer’s income tax return. And as Lauer pointed out, the IRS wants to minimize the collection resources the agency is spending on tracking down the right TIN information associated with those 1099s along with the subsequent enforcement of income tax collection that goes with it.

First wave of penalties to be issued in September

In July, the IRS formed the Backup Withholding Enforcement Unit out of the Cincinnati office. According to Lauer, this new unit will issue penalty notices in September to payers that filed 2018 Forms 1099-MISC with missing or obviously invalid TINs and for which there is no corresponding backup withholding reported in Box 4.

The letter will include a proposed penalty for the taxes that should have been withheld plus penalties and interest for failure to withhold and deposit taxes by the due date. The IRS did confirm that payers will have the opportunity to provide a reasonable cause explanation in an effort to qualify for consideration of penalty abatement.

What’s next for Backup Withholding?

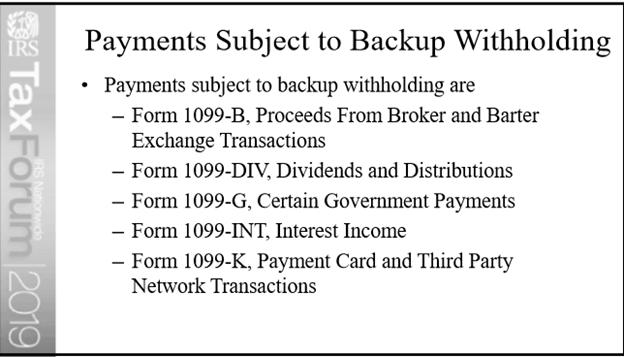

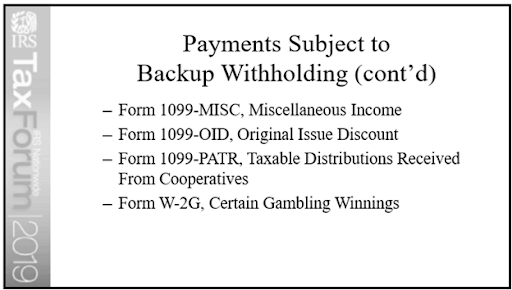

Since backup withholding applies to a variety of payments and other Forms 1099, Sovos clarified whether the IRS intends to penalize payers for similar withholding discrepancies found on other Forms 1099. Lauer referenced a couple of slides (see below) from his presentation at the Nationwide Tax Forum that listed all Forms 1099 currently subject to backup withholding and confirmed that they will expand the program to include all of these forms in due course.

This is not surprising. As Lauer stated back in March, the IRS will continue to grow this program. “It’ll evolve over time,” Lauer said. “We’re going to test and learn.”

Take Action

Learn how Sovos keeps clients up to date with all the latest changes in IRS 1099 policy.