This blog was last updated on June 6, 2024

The IRS released Proposed Regulations this week that permanently extends the time for businesses to provide the Recipient copy of Forms 1095-B and 1095-C. Rather than continue to issue annual Notices to extend the date to issue the statement to the recipient, these regulations propose to permanently amend §1.6055-1(g)(4)(i) i to automatically grant filers a 30-day extension of time to issue the Forms 1095-B and 1095-C to recipients go-forward.

From 2015 through 2020, the IRS has issued annual Notices extending the due date for businesses to issue the Recipient copy of Forms 1095-B and 1095-C. Last fall, the IRS issued Notice 2020-76, which again extended the due dates; however, the IRS hinted that 2020 may be the last year that filers receive the extension of time. After receiving comments from the industry expressing concern over the statutory end of January due date to mail recipient statements, the IRS moved to provide an automatic annual 30-day extension in these Proposed Regulations.

For 2021, the due date to furnish recipient copies is March 2, 2022. Filers should note that with these Regulations, they will no longer be able to request an additional 30 days to furnish recipient statements. These Proposed Regulations provide for a one-time automatic 30-day extension every year – and eliminate the option for the IRS to grant any additional relief to a Filer beyond that initial 30 days.

Alternative Method for Furnishing Form 1095-B is adopted. The Regulations permanently adopt the relief outlined in previous notices that allows some Filers to issue an electronic recipient copy of Form 1095-B rather than printing and mailing the form. Specifically, for applicable filers a notice must be prominently displayed on the company website indicating where the tax information may be accessed. The filer must also include an email address, a physical address to which a request may be sent and a telephone number that responsible individuals may use to contact the business with any questions. For audit purposes, the IRS clarifies that these electronic statements and notices must be retained on the website until October 15 of the year following the calendar year to which the statement relates.

Due dates for Filing with the IRS do not change. Remember, Forms 1095-B and 1095-C must be filed with the IRS no later than February 28 annually if filing on paper, and no later than March 31, 2022 if filing electronically. Nothing in these Proposed Regulations changes those due dates.

Relief not extended to Reporting Penalties

While these Proposed Regulations provide for permanent relief for businesses in many areas of ACA reporting, penalty relief was not amongst them. Whether a business files Forms with incorrect information, files the information late (or not at all), or files the information using the incorrect formats, these penalties apply. Previously, the IRS granted relief to filers from penalties associated with filing Forms 1095 information that contained invalid or missing name and taxpayer identification numbers (TINs) or missing or invalid dates of birth. The regulations make clear that the industry has had sufficient time to implement the ACA reporting requirements and that relief will no longer be granted beyond the 2020 year.

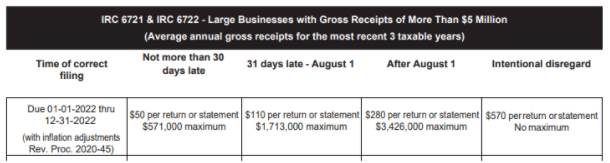

Sections 6721 and 6722 penalties are applicable on all information returns issued and filed with the IRS including Forms W-2, 1099, 1098 and 1094/1095 series. For returns filed for the 2021 calendar year, the penalties graduate from $50 per error to $570 per error depending on the timeliness or nature of the penalty.

Publication 1586 Reasonable Cause Regulations & Requirements for Missing / Incorrect TINs

For 2021 returns and beyond, Filers should expect to receive an annual 972CG Notice of Proposed Penalty from the IRS for any Forms 1095 submitted with missing or invalid names and TINs.

While these regulations are not final, the IRS specifically states that businesses may rely on these Proposed Regulations for purposes of preparing for the 2021 ACA tax reporting season.

Take Action

Avoid penalties that can amount to $280 per return and $3.426 million a year. Learn how Sovos can help you with ACA compliance.