This blog was last updated on March 9, 2023

By Wendy Walker, Solution Principal, Sovos and Jessica Metts, Director of Client Services, Comply Exchange

With the 1042-S reporting deadline approaching , Comply Exchange recently partnered with Sovos to deliver a webinar breaking down the end-to-end information reporting and withholding lifecycle. A lot of withholding agents or payers do not think of the information reporting and withholding process as a lifecycle, as organizations are often decentralized, and requirements are handled by different lines of business. However, it is a lifecycle that begins with the collection, validation and ongoing management of tax documents. Let’s examine the role the W-8 series of forms plays in 1042-S reporting and why these tax forms are crucial for setting your tax team up for success.

What is the information reporting and withholding lifecycle?

The information reporting and withholding lifecycle can be broken down into six steps:

- Collect tax documentation to document payee’s status as U.S. or foreign

- Review documentation for accuracy and validity

- Verify other due diligence requirements, such as validation checks (including TIN and GIIN)

- Calculate withholding before time of payment

- Review/validate information on file for payees

- Conclude reporting – 1099 or 1042-S

What type of Forms W-8 are there?

Unlike the single page Form W-9, there are several types of forms that could be used by non-U.S. persons/nonresident aliens. Have a look below at the types of Forms W-8 that you may be required to collect:

- Form W-8BEN

- Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals)

- Form W-8BEN-E

- Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities)

- Form W-8IMY

- Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting

- W-8EXP

- Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding and Reporting

- Form W-8ECI

- Certificate of Foreign Person’s Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States

- 8233

- Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual

What validations should be completed for new and updated W-8 forms?

While collecting tax forms upfront is important, it is equally important that you validate these tax forms. This includes validating the forms for accuracy based on the latest IRS requirements, and validating the information provided on the tax form against any existing data you have on file such as through AML/KYC processes.

While the validation process is quite complex and extensive, there are some recommended key validations when receiving a new or updated Form W-8. It is important to note that the validations do vary depending on the Form W-8 being collected. General validations that should be required, at a minimum, as part of your validation process include:

- Checking that all required lines on the form have been completed

- Ensuring a signature and date were provided

- No crossing out or altering of forms or certifications

- Confirming that any treaty claim/claims for a reduced rate of withholding are accurate

- Validating U.S. TINs (SSN, ITIN, EIN) and GIINs provided

- Examining checked status boxes to confirm they don’t conflict with one another

- Checking that the most recent Form W-8 revision was used

How should you manage Forms W-8 on an ongoing basis?

Unlike the W-9 form that does not expire unless there is a change in circumstance that causes any of the information on the form to be incorrect, Forms W-8 require much more ongoing management. For starters, Forms W-8 are updated by regulatory agencies far more frequently than the Form W-9, and many of the Forms W-8 have a true form expiration, expiring within a three-year period. This means that a withholding agent or payer should have either software or manual processes in place to manages the ongoing maintenance and verifications of these forms.

This causes a lot of internal struggles for companies that think of documentation as a one-time requirement. A withholding agent or payer should make sure that they have current and valid documentation on file, which again includes monitoring for things like changes in circumstance that could render a form invalid and monitoring for true form expiration. With a key focus on technology today, companies are looking towards tax technology companies to act as a document repository, securely storing, maintaining, and monitoring tax forms as this is a living, breathing, day-to-day process.

How does information from Forms W-8 flow onto Form 1042-S?

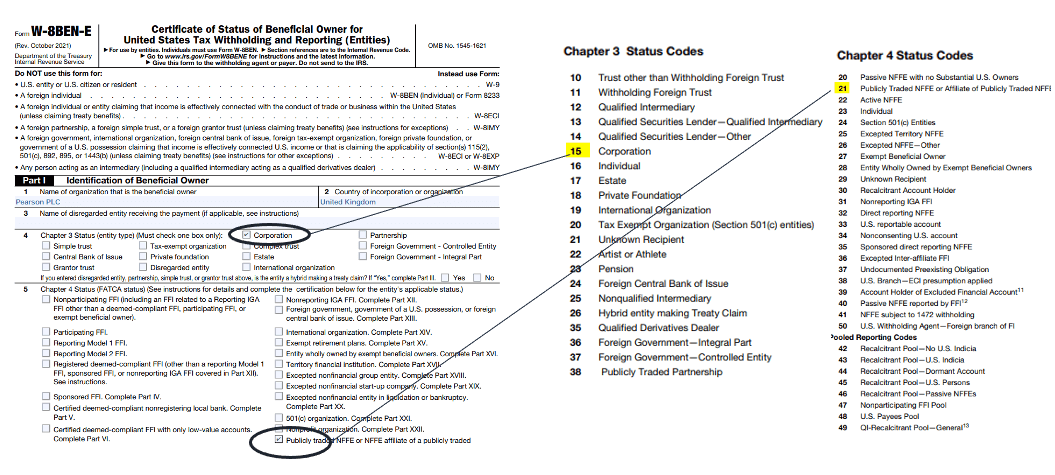

While reporting gets a lot of focus, withholding agents often forget that the information coming off your recipients’ Forms W-8 directly feeds into the information required to be reported on the Form 1042-S. This includes the basic identify information, like name, addresses and tax identification numbers, as well as the status codes that are required on the 1042-S.

Looking at the example below, you can see where the Chapter 3 and Chapter 4 status codes are directly mapped from the Form W-8BEN-E:

How does Comply Exchange assist with W-8 and 8233 form management?

Comply Exchange provides tax software to automate the collection and management of Forms W-8 and 8233, together with real-time validation and withholding rate calculations. This alleviates the burden of withholding agents having to manually collect, validate and manage these tax forms, along with minimizing the risk of noncompliance as a result of faulty processes or human error.

A key point of collecting and validating tax documentation is so that as the withholding agent or payer, you know who you are paying (U.S. or foreign) and how to withhold on that payment prior to making the payment. If you do not know who you are paying, there may be requirements to presume the person as U.S. and backup withhold at a rate of 24%. If you do receive a Form W-8 with a claim of tax treaty benefits and you do not validate that treaty claim, then you could incorrectly withhold at a lower rate instead of the required 30%.

In both cases, as the withholding, you then become liable for the failure to withhold correctly or at all and become subject to that withholding plus potential penalties and interest.

Take Action

Check out the on-demand webinar with Sovos and Comply Exchange to learn more about Form W-8 and what your requirements may include.