This blog was last updated on January 19, 2024

In the world of ever-evolving regulation changes, staying informed is crucial for businesses to achieve complete compliance in their tax information reporting processes. In 2023, the IRS rolled out significant updates that businesses need to be aware of ahead of filing season. We have summarized the most impactful changes you need to know about for a successful and compliant reporting season.

Annual reporting penalties take a leap

The IRS (or inflation) is turning up the heat on annual reporting penalties. Annual reporting penalties found under Internal Revenue Codes 6721 & 6722, were increased again for 2024 reporting season. These penalties, which are issued annually via Notice 972CG, are issued for filing late returns, filing using the incorrect medium (i.e., via paper instead of electronic) and for filing returns with incorrect information. Adjusted this year for record inflation, applicable penalties reach up to $310 per return with a maximum annual penalty of over $3.7 million.

Navigating the transition for TPSOs

The IRS gave Third-Party Settlement Organizations (TPSOs) another grace period for 2024 reporting season. As stated in IR-2023-21 the IRS will not enforce the new $600 Form 1099-K reporting threshold for 2023 returns and instead kept the $20k with a minimum of 200 transactions threshold intact for this season. Further, for 2024 returns filed in early 2025, the IRS has introduced a new reporting threshold of $5k. These extended grace periods will allow for an easier transition period for the IRS, 1099-K filers and taxpayers. Caution! It is important to keep an eye on specific direct-state reporting requirements, with several, including AR, DC, IL, MA, MD, MS, MO, NJ, VT and VA, requiring 1099-K reporting at lower thresholds than the IRS for 2023 returns.

IRS electronic filing changes

The IRS is making strides in electronic filing, as announced in T.D. 9972. Authorized by the Taxpayer First Act of 2019 (TFA), the IRS lowered the electronic filing threshold for certain information returns. For 2023 returns, businesses must file electronically if the aggregate of all returns issued is at least 10 or more information returns. Previously, the eFile threshold was 250 returns and was applied to each type of return separately.

Additionally, the new law requires that taxpayers also must file corrected information returns in the same manner that the original version was filed. Meaning you cannot file an original return electronically and file a correction on paper, you would need to file both versions electronically.

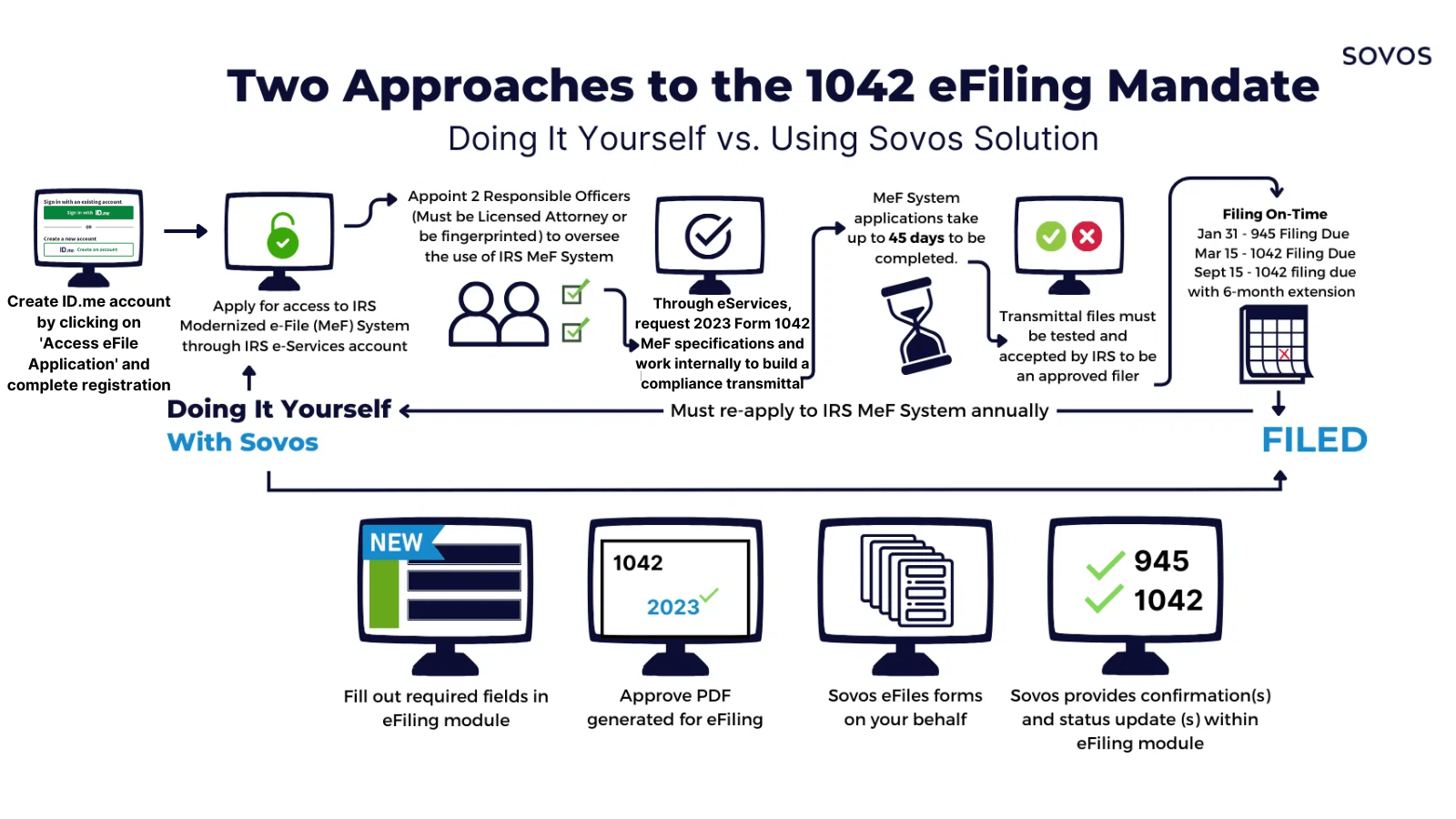

The digital transition of Form 1042

Another return included in the eFile threshold change is Form 1042 Annual Withholding Tax Return for U.S. Source Income Paid to Foreign Persons. For 2023 transactions, this form is required to be filed electronically if a business issues at least 10 or more information returns. However, all financial institutions are required to file Form 1042 electronically regardless of whether they meet the 10-return threshold. Previously only submitted to the IRS via a paper return, Form 1042 is now required to be filed electronically in the IRS’ Modernized E-File (MeF) system. This system requires different credentials than those needed to access other IRS systems to file information returns (like FIRE). In addition, Form 1042 data will be required to be eFiled following an entirely different schema than information returns.

Sovos offers a solution for your Form 1042 eFiling needs. As one of the only 2023 approved MeF filers, our comprehensive solution is able to file your Form 1042 electronically on your behalf, without the added headache of gaining MeF approval for your business.

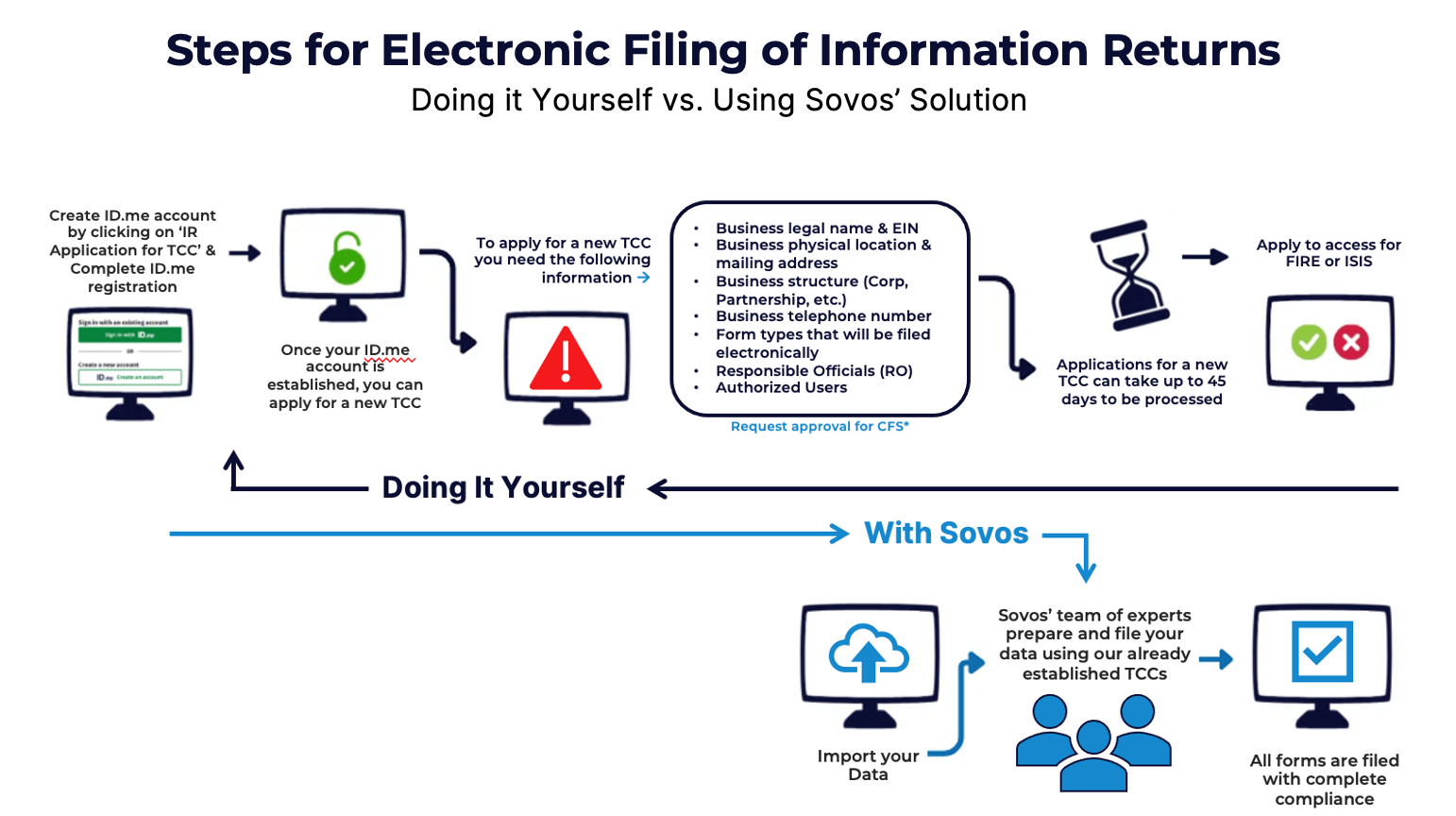

The key to eFiling information returns in IRS systems

No matter which information return(s) your business is required to electronically file, the IRS systems all require a valid Transmitter Control Code (TCC) to do so. Understanding the TCC process is essential in the eFiling landscape. TCCs that were issued to a business prior to August 1, 2023, were required to be associated with updated credentials in the IR Application for TCC. After August 1, any TCCs not associated with an active profile in that system were set to be deactivated. Therefore, if you did not login to the IRS Application for TCC and establish new identity credentials by August 1, you will need a new TCC to access IRS systems such as IRIS or FIRE to submit 1099 data and eFile your 2023 returns.

Publication 1220 updates

The 2023 Publication 1220 brought a mix of anticipated and surprising changes. Though there were no layout changes to filing specifications, the publication did call out changes like the 2023 eFiling mandate. Also included in the publication was clarification on use limits for TCCs, indicating that a TCC can be associated with up to 1,000 files per year. Any filer needing to submit more than 1,000 files will need to request another TCC to be associated with any files that need to be submitted over that limit.

Additionally, the publication provided clarification on the IRS’ Combined Federal State Filing Program (CFSF). The District of Columbia (D.C.) & Pennsylvania (PA) are both listed as participating in CFSF. Sovos has confirmed with both D.C. and PA that they are participating, however both will also still require businesses to file information returns directly in their portals. Therefore, CFSF will not satisfy direct reporting obligations for D.C. or PA for 2023 returns. It is not uncommon for a state to be listed in the IRS Publication 1220 as participating in CFSF but then for that state to still require a business to file information directly in the state. Massachusetts, Maine, Minnesota and more all are listed in the IRS Publication 1220 as participating in the CFS program, yet still require information returns to be reported directly in their respective portals.

Form overhauls

We did not see a lot of changes to forms this year, but there are a few format changes to be aware of ahead of filing with the IRS:

- Form 1099-B: Instructions now include a note for reporting closing transactions.

- Forms 1099-MISC / NEC: The calendar year designation “20__” has been removed, making way for a fill-in line for filers to populate all four digits of the year.

- 1099-PATR: Converted to continuous use for seamless reporting.

- 1099-R: Instructions updated to indicate that mandatory withholding at the rate of ‘Single with no adjustments’ is required on periodic distributions lacking a valid Form W-4P instead of the old rate of ‘married with 3 adjustments’

Crypto regulations on the horizon

For those involved in crypto transactions, the IRS has proposed significant changes. Digital assets will soon fall under new 1099 reporting regulations, requiring brokers to report transactions using the new Form 1099-DA starting with 2025 transactions. The definition of brokers and reportable digital asset transactions is very broad, sparking industry debate and fiery comments to the IRS in response to the proposed regulations. The IRS held a public hearing in November and is expected to release final reporting regulations sometime in 2024.

Take Action

Watch our recent webinar “Navigating Tax Year 2023’s Most Impactful Regulatory Updates” to learn more about combatting new regulations for reporting season.