Revisiting the EU VAT “2020 Quick Fixes”

Part 2: The Exemptions of Intra-Community Supplies of Goods This is the second in a series of four blogs providing explanatory detail to the EU’s

Part 2: The Exemptions of Intra-Community Supplies of Goods This is the second in a series of four blogs providing explanatory detail to the EU’s

It’s no longer controversial to say that real-time VAT control initiatives such as e-invoice clearance or real-time reporting are becoming increasingly popular with governments and

Gemini, one of the world’s most trusted cryptocurrency exchanges and custodians, has selected Sovos, the largest private filer of 10-series tax forms, to automate Gemini’s

Nice job on getting your fall filing done! You deserve a reward! Take the rest of the day off and make yourself a drink I

What to Expect Next In Parts One and Two of this series on the VAT MOSS scheme for digital services we provided a background, considerations for

Introduction Tax information reporting and withholding at the state level is often a complex undertaking for organizations to manage. With 43 states now requiring income

Recently, a landmark ruling in New York shed light on a nationwide trend in the world of unclaimed property compliance. State governments across the U.S.

Unclaimed property results from the everyday functions of a company’s operations. As state budget deficits continue to grow, companies should expect unclaimed property compliance and

An update and the effects of Brexit In the first part of this series on the VAT MOSS scheme for digital services we provided a

Ron Quaranta is founder and chairman of Wall Street Blockchain Alliance, the world’s leading non-profit trade association promoting the comprehensive adoption of blockchain technology and

If you have ever had a child wait until the night before an assignment is due to ask for help, or had a client push

Brazil is often viewed as one of the most complex tax jurisdictions in the world. But, at the same time, it has been very successful

Managing an organization’s unclaimed property can be a full-time job. With the complexities of regulatory requirements, the numerous due diligence and dormancy tracking rules by

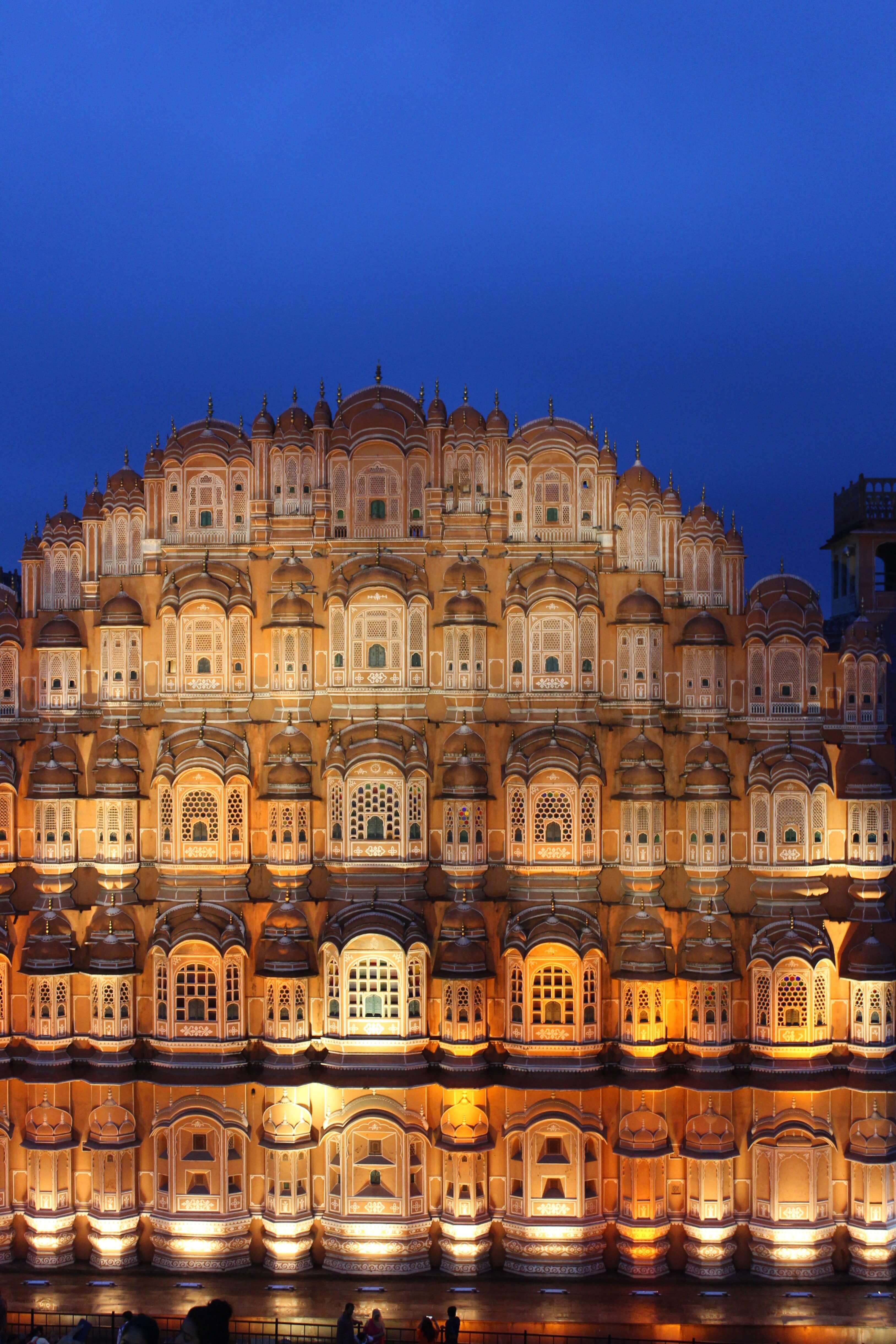

Following India’s recent public consultation looking at the proposed introduction of an e-invoicing regime, the GST council has now released a white paper on the

“We have less than $1,000 to submit, we’ll just do it ourselves.” Does this thought process sound familiar? The thought is if it’s a small

The IRS released long-awaited guidance on cryptocurrency tax regulations this week, but the agency did little to clarify tax reporting policy. The guidance, the first

Many companies ask me about filing to Alberta. There is some confusion about which companies really need to file to Alberta. If your company is

The issue of online unclaimed property reporting is an important one. State legislation varies widely on when and how to submit unclaimed property reports, and many states