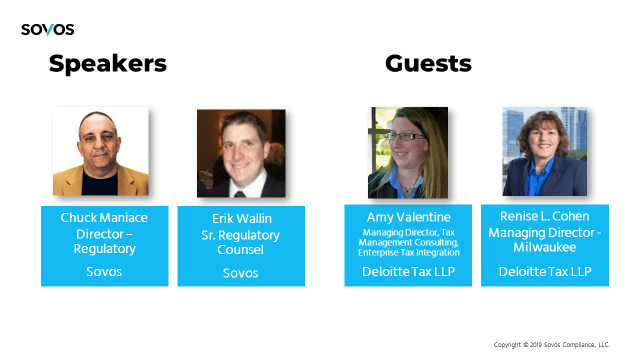

On March 21, Sovos and Deloitte Tax LLP teamed up on a webinar, “The Speed of Sales Tax – How to Stay Ahead of Changing Regulations in 2019,” discussing trends in sales tax compliance that will impact tax professionals’ day-to-day processes and work.

Below is a brief recap of the major trends that were discussed from the past year and predictions for 2019 based on recent sales tax law changes.

Taxability changes based on public policy-driven changes

Many state sales tax law changes have occurred over the past year and as we get deeper into 2019 have been directed towards public policy-driven concerns. Whether it was the introduction of an excise tax on bicycles in Oregon to improve cycling infrastructure, reducing or eliminating the tax on feminine hygiene products, or making sales tax holidays permanent (like in Massachusetts), this past year saw some major landscape changes in sales tax related to health and well-being.

Tax on SaaS and technology

Jurisdictions such as Arkansas, District of Columbia and Iowa began taxing digital audio/visual works as streaming platforms have become large revenue generators. Indiana and Rhode Island are finally taxing cloud-based transactions software (i.e. SaaS), having already taxed regular software transactions for years.

Other states are seeking to become more “business of technology” friendly and incentivizing businesses to move data centers within their borders by moving to exempt certain qualified equipment.

Wayfair economic nexus recap

A look at the past year wouldn’t be complete without a quick mention of South Dakota v. Wayfair. Currently, 35 states are enforcing economic nexus rules, with California set for April, Texas in October, and Pennsylvania already beginning enforcement in 2019. A few of the eight remaining states without economic nexus rules are in various stages of passing bills. New Mexico and Virginia may pass bills in short order, while California and Texas may enact a blended state and local rate to make administration a bit easier. However, the question remains, in states such as Alabama and Louisiana that use blended tax rates, if you’re selling to a jurisdiction with a lower rate, can the buyer get a credit for that tax? Time will tell.

Economic nexus transaction threshold – no magic in the numbers

With some states counting economic threshold transactions differently, whether by gross sales, taxable sales, retail sales, exempt sales, etc., there’s been speculation that states may eliminate the number of transactions threshold when adopting Wayfair rules. By doing so, states would eliminate the need for small taxpayers, which are not going to produce any meaningful revenue for them, to register and collect in these states. For example, Washington, a state currently taxing based on the amount of retail sales (having eliminated the 200 transaction threshold), is moving away from gross receipts on retail sales to cumulative gross income starting January 1, 2020.

For more details, including:

- Colorado notice and reporting emergency rules implemented in December 2018 and the impending grace period deadline

- New marketplace rules by state and what this means for marketplace sellers

- 2019 predictions including new Streamlined Sales Tax states that may come online

- Tipping points for automation and how use tax may evolve…take action below

Take Action

Download the presentation slides and recording to listen at your leisure.