This blog was last updated on March 11, 2019

For corporate tax professionals concerned with 2018 tax trends and maintaining sales and use tax compliance with the numerous changes in the tax compliance landscape in the U.S. this past year – as well as those emerging on the horizon, – our Webinar, “U.S. Sales and Use Tax Trends 2018 – A Shifting Landscape,” was seen as a “valuable” and “eye-opening” 60 minute experience.

Here are some highlights so you can more quickly dig into the details at your leisure based on the four areas that were covered (and the exact minute marks to fast forward to). Mainly, our panelists took a look at the new reality in tax compliance, the world of Nexus, various new state legislation such as the Soda or Sugary Beverage Tax and how they could relate to other upcoming changes, and a gaze into our crystal ball for some 2018 predictions on Sin Taxes, Gross Receipts Tax, an expansion of the Sales Tax Base, Marketplace Providers and Facilitators, Remote Sellers, and more.

Two indirect state and local tax experts from Grant Thornton joined Chuck Maniace (you may know him from previous webinars, or numerous appearances in the media and our own “Chuck TV“) to delve into some major recent regulatory tax news and prognosticate on some scheduled changes that will disrupt the tax compliance market later this year.

A New Reality in Tax Compliance

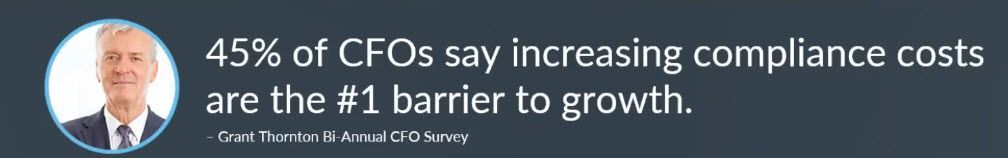

A look at what’s driving all the regulatory changes across the world of sales and use tax. Our panelists touched on the huge Tax Gap (the difference between all the tax money that could be collected under current rules vs. what is actually collected) that exists in the U.S. (did you know it is estimated at $23.3B? – Transactions escaping taxation), how the government and states are hungry for more revenue, and what that means to you.

One thing is for certain: Technology has changed the way businesses operate, which has exacerbated the tax gap and how governments regulate. Compliance is getting far more aggressive. Most returns these days are transmitted electronically, and if they are even a second late a penalty notice is sure to be on its way from the state.

8:10 minute mark – Jump to 8:10 in the below webinar recording for more great insights around the Internet of Things, Big Data, Analytics and how states are making sure organizations are in compliance with more comprehensive and sophisticated audit approaches. Say goodbye to “good faith” filing…

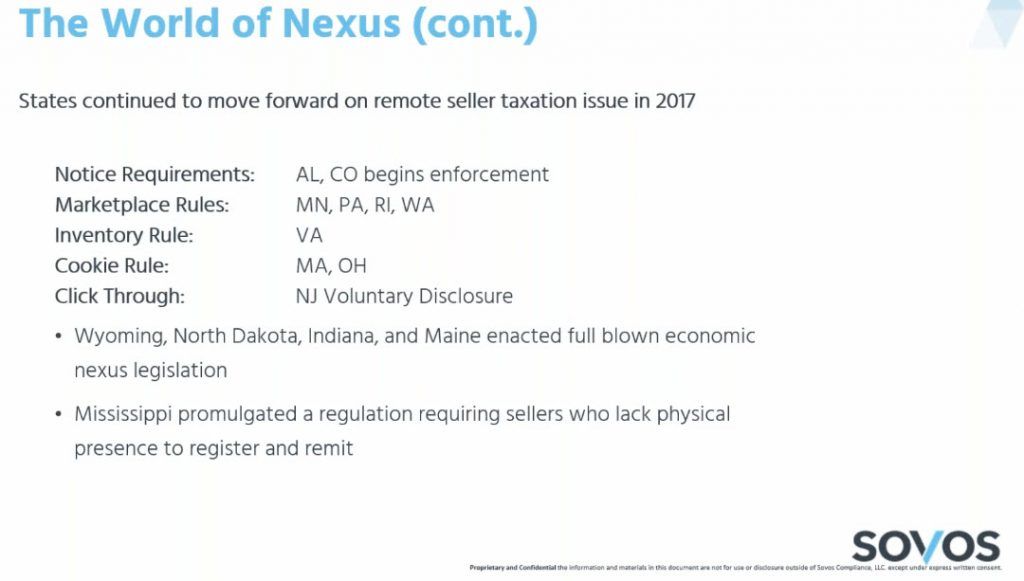

The World of Nexus

A look at the Quill Doctrine and how states have continued to nibble at the fringes of Quill (Quill vs. North Dakota 1992) to find ways to apply their tax so eCommerce transactions from remote sellers don’t escape to the extent that they can.

Covered: 16:30-minute mark

- Click-through Nexus

- Notice and Reporting Requirement Provisions (Colorado for e.g.) (27:25)

- Cookie Rules – deep dive into Massachusetts, and the move to Ohio, etc. (21:28)

- Marketplace Liability

- Payment Processors and other Entities

- South Dakota v Wayfair – Things are Getting Interesting (33:20)

Soda Never Tasted So Sweet – To Regulators

Covered: 40:35-minute mark

Here our panelists discuss the continuing trend of using tax to influence behavior and concurrently drive revenue. They take you from Seattle to Cook County, Illinois, New York to Philadelphia. Some great “food” for thought for other locations who may be considering basing their tax rate on ounces versus dollar amounts, or restaurants dealing with unlimited refills. Are states creating situations where it’s too difficult for sellers to comply?

This section goes well beyond just sugar tax, give it a look.

A Look into the Crystal Ball – 2018 State Sales Tax Predictions

Gross Receipts Tax (46:32 minute mark)

A discussion of how states will likely enact legislation converting from a corporate income tax to a gross receipts tax to help bolster state revenue, with federal tax legislation now in place (commerce tax in Nevada, for example).

Expansion of the Sales Tax Base (47:47 minute mark)

Our panelists believe states will likely introduce legislation to tax a significant number of services. What kinds of services will be targeted? Software-as-a-Service (SaaS) is a non-traditional type of service that sixteen states already impose a sales tax on, so anticipate a wider reach on that. It’s going to be hard for states to tax more traditional services and define what a taxable service is. What many try to do is shove more services into existing laws to make it taxable, like Texas has done with data processing services, but it will get interesting.

Marketplace Providers and Facilitators (50:50 minute mark)

Marketplace providers at this time next year may be a bigger thing in a world where Quill doesn’t exist anymore. What role will marketplace providers have in enabling small seller compliance?

Remote Seller Special Voluntary Disclosure Initiatives (52:19 minute mark)

As we saw, the Multistate Tax Commission’s multi-state voluntary disclosure initiative was not very successful. The amnesty program was pretty narrow on who could benefit from it. Our panelists had some strong opinions on what could be next. One even predicted at least two states outside those that participated will provide their own special amnesty/voluntary initiative targeted towards remote sellers.

Sin Taxes (54:18 minute mark)

Traditional sin taxes include liquor, gambling, and tobacco. Now there’s a new push to impose sales tax on the consumption of meat. Others include sugary beverages, bags and marijuana. It goes back to the greenhouse gas emissions and public health issues. Will chickens be taxed less than cows? Will it be per ounce? A retail tax or a wholesale tax? We shall see…

Watch the onDemand replay today.

Is Your Team Ready for these Changes?

Watch the onDemand recording of our Tax Tuesday webinar, Building the Tax Team of the Future to Navigate the Storm of Regulatory Change. Also, receive the Team Measurement Worksheet on the onDemand assets page to see how you measure up to your peers on the Reactive-Proactive Scale.