This blog was last updated on March 7, 2023

By Judy Vorndran, J.D., CPA, TaxOps and Nancy Steele, TaxOps

To deal with the uncertainty of evolving sales and use tax policies in numerous jurisdictions, businesses have increasingly turned to software providers to deliver the right rates and calculations for each transaction. Unfortunately, calculating the amount of tax due is only part of what it takes to stay compliant. First, it’s essential to find the right sales tax automation tool for your organization. But how do you know you’re making the right investment?

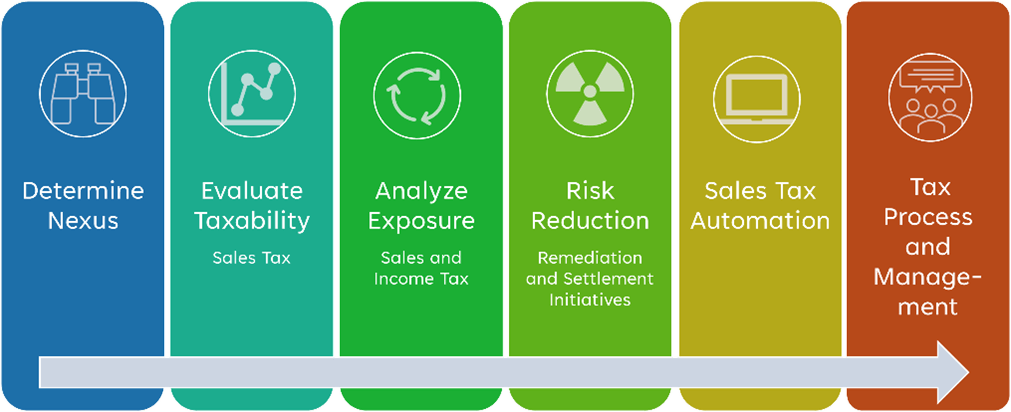

Businesses must properly administer sales tax from point of sale through remittance and reporting. Sales tax automation is an integral part of a much broader, multilayered sales tax administration process. It’s necessary to peel back the onion by jurisdiction (e.g., state, municipal, home rule, special district), activity and type of tax. This must happen before making key decisions around what your business does, where it is located and how the company is required to comply. It is only then that businesses are ready to evaluate which sales tax automation tool is the right fit for successful integration and ongoing compliance.

Administration before automation

Sales tax automation tools are typically prospective in nature, supporting compliance going forward. They do not fix prior instances of non-compliance or resolve past errors. However, some managed services teams offer back filing options, which could be beneficial for companies that may have had compliance issues in previous filing seasons.

Overall, businesses must use an administrative lens to understand past, present and future activities that impact sales tax liabilities, risk and business strategies. This includes analyzing your business’ nexus (physical and economic), potential risk exposure, taxability requirements, sales tax and income tax. Sales tax registrations beget income tax obligations, so do not overlook income tax as a source of risk in your sales tax compliance plan.

Once the landscape of what you have and what you need is defined, it is time to evaluate sales tax software.

Focus on past, present and future needs

When selecting an automated service solution, be sure to consider the business’ footprint, sales volume (number of transactions and dollar amount), taxability of items, general ledger system integration and managed services requirements.

In addition to the technical components that must match up, businesses also make decisions around internal resource allocations, maintenance protocol and ongoing administration. Hiring a product-agnostic expert can help you vet each option, choose the right solution for your operations and then implement appropriate management procedures for compliance. An automated sales tax solution can help your business streamline the entire sales tax process and free up internal resources to focus on other key business initiatives.

Although every business taxpayer enters the selection process with a unique set of facts and circumstances, here are some basic questions to ask during your search:

- What are the strengths and weaknesses relative to your business?

- Do we need end-to-end or ala carte options for integration with legacy systems?

- Do we have processes in place for purchasing, installation and management?

- What installation obstacles (i.e., connector challenges) do we have?

- What support and training resources do we need?

View the entire sales tax picture

The right sales tax automation tool is managed by a knowledgeable person or team, either in-house or outsourced, that understands the end-to-end compliance process and the details of administrative tasks, including:

- Error management

- Invoicing protocol

- Exemption certificates

- What returns to report and where

Whether you are evaluating sales tax automation solutions for the first time or considering a change, remember to take a comprehensive view of your organization. Compile the right team to help manage the process and opt for a solution that can grow with your business. Sales tax is complicated but staying compliant doesn’t have to be.

Judy Vorndran leads the SALTovation team at TaxOps. She has been making sense of state and local tax for businesses for over 25 years. Nancy Steele coordinates state and local tax at TaxOps.