This blog was last updated on May 9, 2019

The Chief Procurement Officer may not be the first employee that comes to mind when the acronym CPO is used, yet over 100 of them joined Ardent Partners in Boston a few months ago at the CPO Rising 2018 Summit to exchange and improve the procurement function through innovation and thoughts around P2P, accounts payable process automation.

In its 2018 Ardent Partners’ 13th annual “State of ePayables” report, the analyst firm argues that despite most businesses going through digital transformation to digitize the entire business, Accounts Payable departments may require both a business catalyst (such as improving procure-to-pay operations) and a strong executive sponsor (CFO) or functional partner (like procurement) to earmark dollars and initiate the transformation.

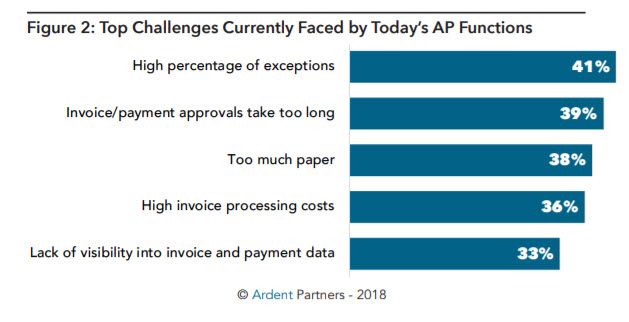

Top accounts payable process challenges

Invoice exceptions were stated as a top challenge by 41 percent of the organizations in the “State of ePayables” report. While there are many reasons an exception may occur, increasing time to acquire missing information and approvals, and missing out on early payment discounts, can both cost a larger organization significantly and frustrate suppliers.

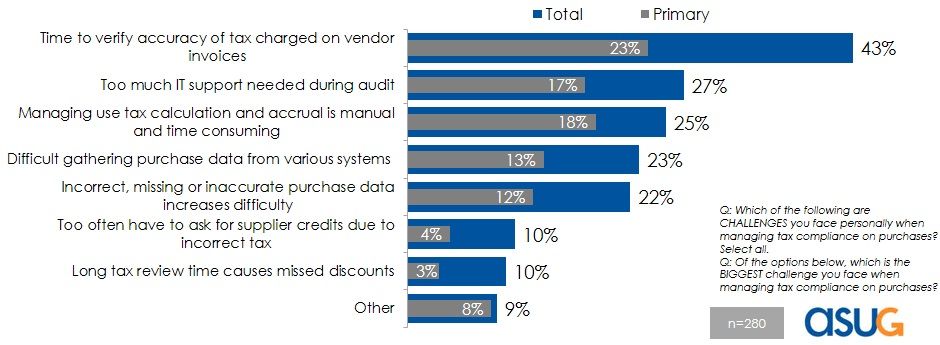

Comparing this to a survey by America’s SAP Users’ Group (ASUG) conducted on behalf of Sovos, it’s interesting to point out that “time to verify accuracy of tax charged on vendor invoices” was by far the top challenge for managing tax compliance in the procure-to-pay process.

Given 24 percent (Ardent survey) of the average AP staff’s time is spent working directly with suppliers to fix invoice, processing and payment errors, and 53 percent (ASUG survey) of department managers indicated only doing a manual verification or manual spot check of tax treatment on invoices, bills or payments, automating the tax validation process on supplier invoices should be a viable solution to improve procure-to-pay and accounts payable process operations.

“The bridge to an intelligent AP function is not built on a single technology or strategy, but rather a series of new innovations and systems that are interconnected and can effectively “speak” to each other in near real-time, producing actionable intelligence across a wide range of corporate arenas, such as supplier management, strategic sourcing, financial management, compliance, cash management, and payment management.”

– Ardent Partners

Sales and use tax factors in vendor invoice validation

Improving AP efficiency and accelerating supplier invoice payments starts with the automation of core financial processes, and many leading businesses are years into these projects. Yet, these automation solutions are not as efficient as they could be if procurement and tax teams are still spending a good part of their time chasing down the data needed to confirm an invoice is accurate in the first place. Incorporating a solution like Sovos Use Tax Manager, an invoice reconciliation tool that ensures a supplier charges the correct sales and use tax, can be a key piece of the procurement puzzle to increase straight-through processing (STP) and reduce monthly over and undercharges. Items on an invoice may be incorrectly assessed for sales and/or use tax based on a number of factors, such as is the item exempt based on:

- How it is being used, or how much of it is being used;

- Where it is being used; or

- What part of the manufacturing process an item is being used?

Some suppliers are better than others at getting this tax treatment correct but usually don’t have enough information to make the correct assessment. Manually reviewing thousands of invoices per month isn’t feasible for AP and tax teams, so they typically resort to spot checking the invoices over a certain dollar threshold.

Wayfair economic nexus puts a wrench in invoice tax treatment

Speaking of thresholds, manufacturers will find suppliers starting to charge sales tax in light of the South Dakota v Wayfair Supreme Court decision. The number of sales or invoices, not just the dollar amount, also comes into effect, only increasing the number of invoices with invalid tax treatment. Manufacturers should pay closer attention to the invoices received from suppliers in the wake of Wayfair and also self-assess use tax as appropriate if they don’t want their procurement process efficiencies to decline.

Take Action

Learn how Sovos Use Tax Manager can safeguard your business against the burden and risks of procure-to-pay sales and use tax compliance, give your tax team the visibility and control needed over tax data on every purchase – without slowing down your Accounts Payable process.