Be a trusted advisor

Drive the digital transformation of your customers' tax and regulatory compliance

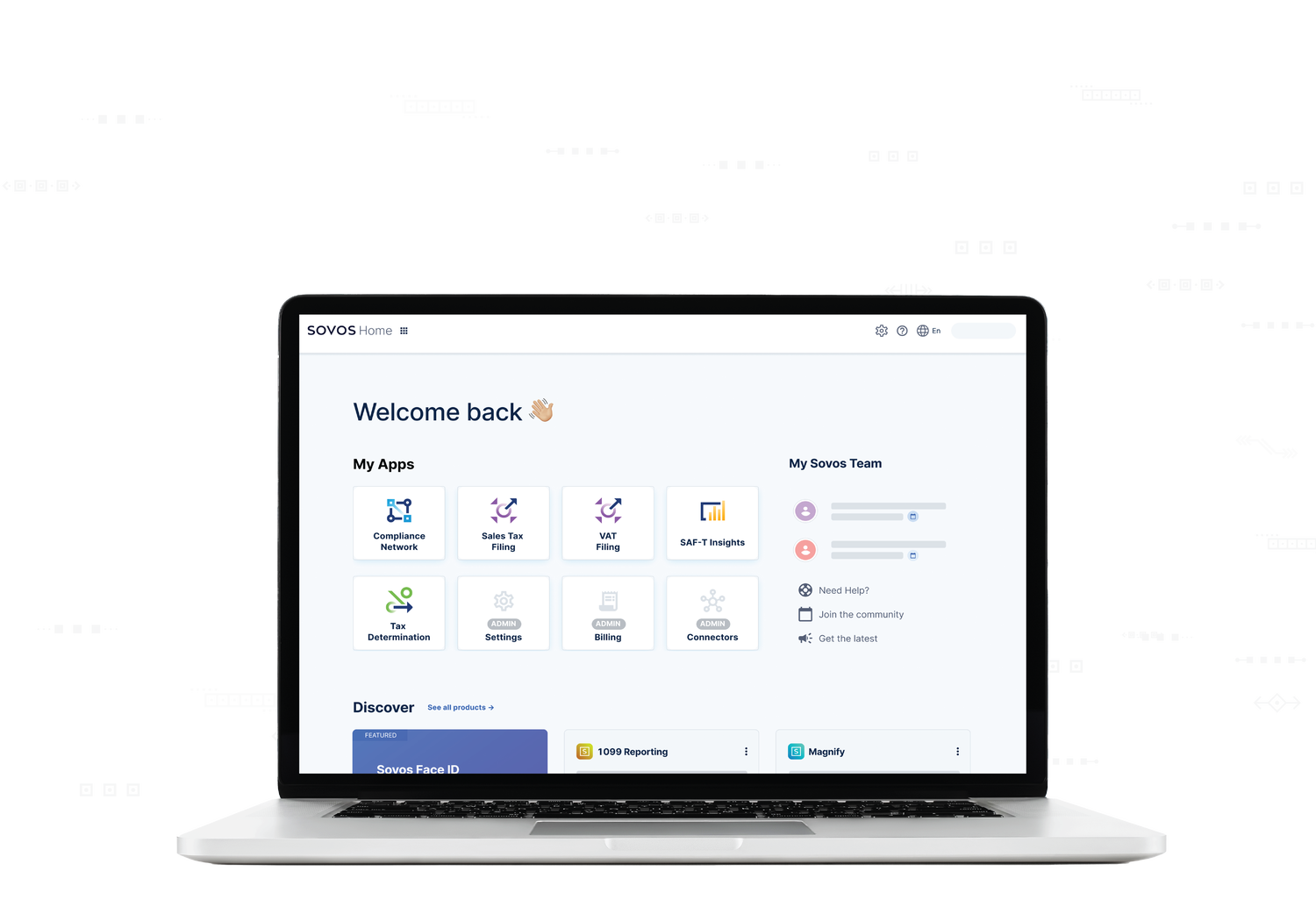

Through the Sovos Compliance Cloud, you can ensure your customers keep up with regulatory changes and eliminate processes that are prone to errors, prompting audits and penalties.

The Sovos Partner Network Program allows you, your ecosystem and your customers to leverage our unified platform for always-on compliance, mitigating risk, lowering costs and providing a seamless customer journey as requirements change.